Alternative Data Monetization For

Investment Decisions

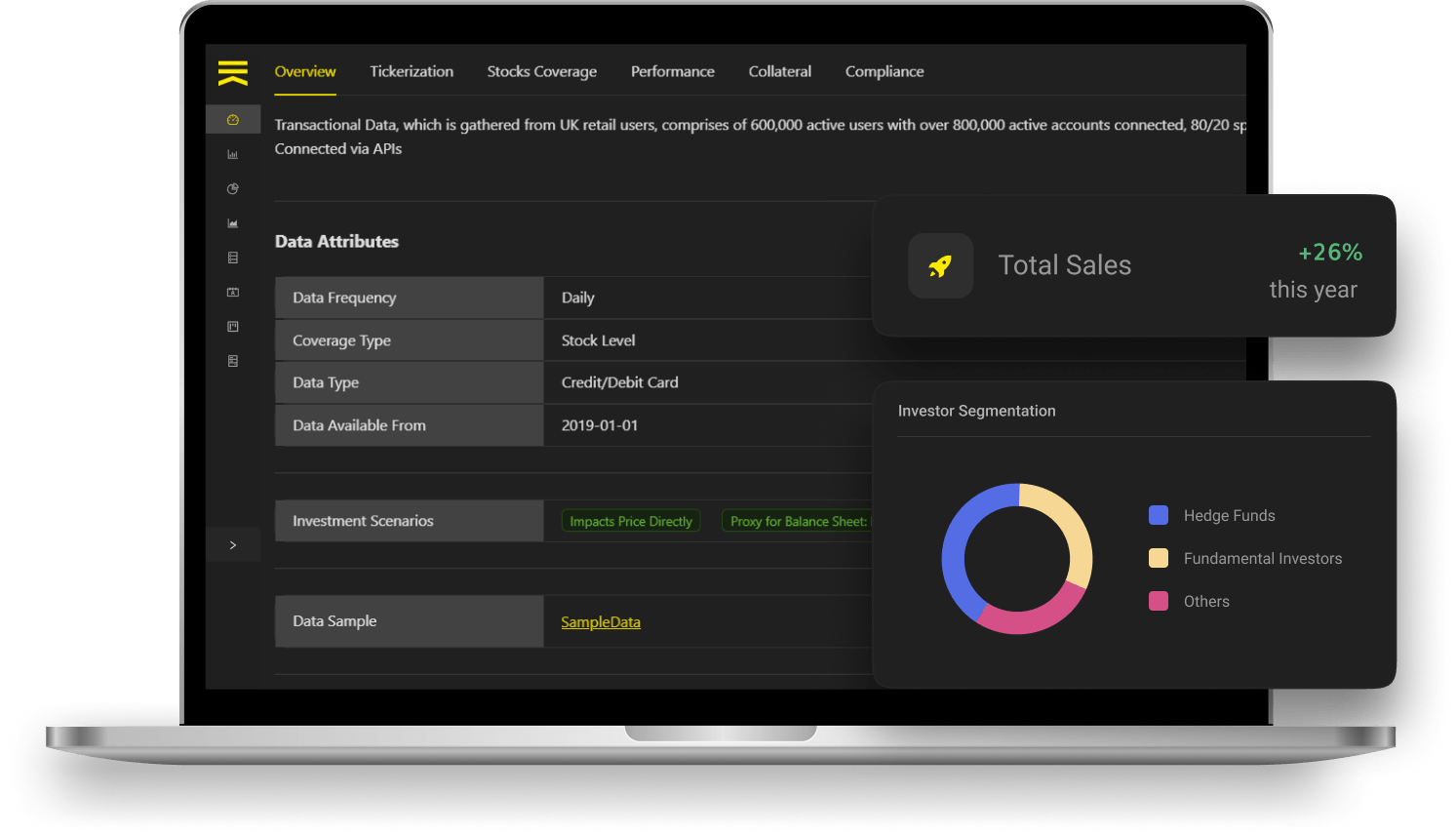

Unlock the power of alternative data for investment decisions with AltHub. Our data monetization platform turns your raw data into actionable insights, generating new revenue streams.

We’re transforming data into opportunities.